Why Offshore Investment Is a Reliable Way to Secure Your Retirement Funds

Why Offshore Investment Is a Reliable Way to Secure Your Retirement Funds

Blog Article

The Crucial Guide to Offshore Investment: Types and Their Benefits

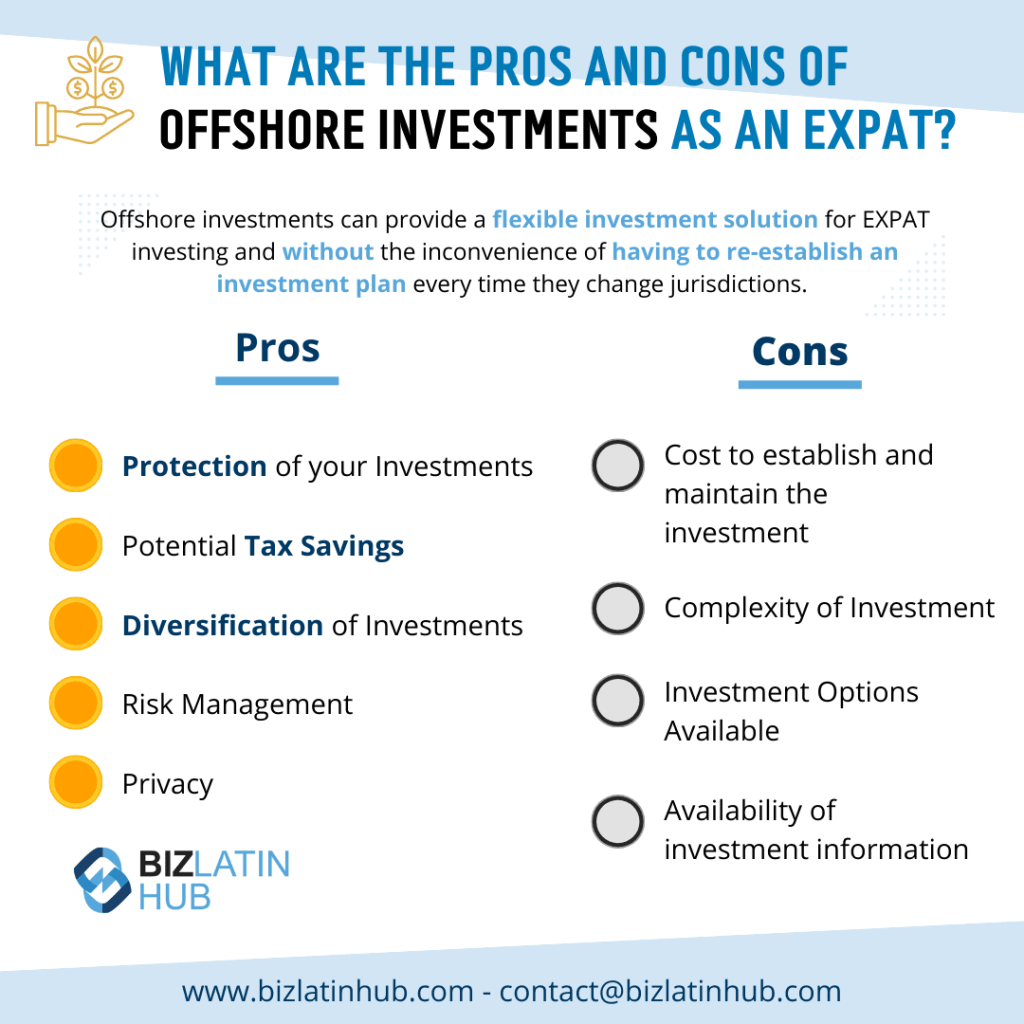

Offshore investment presents an engaging array of options, each customized to fulfill specific economic purposes and risk appetites. From the personal privacy paid for by offshore checking account to the stability of property holdings, the landscape is abundant with possibilities for both asset protection and development. Vehicles such as offshore trust funds and common funds offer paths to diversification and calculated estate preparation. As the international economic situation remains to develop, understanding the subtleties of these financial investment kinds comes to be increasingly necessary for browsing prospective benefits and mistakes. What could be the most ideal selection for your financial approach?

Offshore Bank Accounts

Offshore savings account have come to be significantly popular among capitalists looking for to expand their financial portfolios and safeguard their possessions. These accounts are typically developed in jurisdictions outside the financier's home country, supplying numerous benefits that can boost financial security and privacy.

One main benefit of overseas bank accounts is possession security. By positioning funds in an international organization, capitalists can secure their properties from prospective political or financial instability in their home country. Furthermore, offshore banking frequently supplies better privacy, permitting people to manage their riches without attracting unwanted attention.

Moreover, overseas checking account may offer beneficial tax advantages, depending upon the jurisdiction. While it is vital to adhere to tax obligation laws in one's home country, particular overseas locations give tax obligation motivations to foreign investors, which can cause enhanced rois.

Additionally, these accounts typically offer accessibility to worldwide monetary markets, making it possible for investors to explore diverse financial investment possibilities that might not be available locally. Overall, overseas checking account work as a calculated tool for asset defense, privacy, and economic growth in a significantly globalized economy.

Property Investments

The appeal of property investments proceeds to grow amongst individuals seeking to diversify their profiles and safe and secure long-lasting economic gains. Offshore property offers one-of-a-kind advantages, such as positive tax obligation regimes, possession protection, and the capacity for resources gratitude. Capitalists can leverage buildings in emerging markets or secure economies, enabling accessibility to a larger variety of financial investment chances.

One key advantage of offshore real estate is the capacity to secure possessions from residential financial fluctuations or political instability. Residential property possession in a foreign jurisdiction can offer a layer of protection and personal privacy, commonly interesting high-net-worth people. Investing in rental homes can generate consistent income streams, boosting overall financial stability.

Mutual Funds and ETFs

Spending in exchange-traded funds and mutual funds (ETFs) offers an obtainable opportunity for people looking to diversify their financial investment profiles while lessening threats connected with straight supply acquisitions. Both financial investment vehicles permit financiers to official site merge their resources, allowing them to buy a more comprehensive variety of properties than they could manage independently.

Shared funds are typically handled by specialist fund managers who proactively select securities based on the fund's financial investment objective. Offshore Investment. This management can enhance the capacity for returns, though it often features higher fees. In contrast, ETFs are generally passively taken care of and track a specific index, offering lower expense proportions and better transparency. They can be traded throughout the day on stock market, adding versatility for financiers.

Both shared funds and ETFs use tax advantages in an offshore context. Mutual funds and ETFs serve as efficient tools for building riches while navigating the intricacies of offshore financial investment possibilities.

Offshore Trust Funds

For investors seeking to even more enhance their property security and estate preparation strategies, offshore depends on present an engaging option. These legal entities allow people to move possessions to a count on in a territory outside their home country, giving a variety of benefits that can secure wide range and assist in smooth succession preparation.

One of the main benefits of offshore trust funds is the degree of discretion they provide. By positioning properties in an overseas trust, financiers can shield their wealth from public examination, consequently protecting their privacy. In addition, offshore trust funds can offer durable protection versus legal insurance claims and possible creditors, successfully protecting properties from dangers associated with litigation or insolvency.

Offshore trust funds also allow flexible estate planning alternatives. Investors can mark particular beneficiaries and describe the terms of asset circulation, guaranteeing that their desires are recognized after their passing away. This can be particularly helpful for people with complicated family characteristics or those wanting to offer future generations.

In addition, many offshore jurisdictions have actually established desirable legal frameworks developed to sustain the establishment and administration of depends on, making them an eye-catching choice for discerning investors. Overall, offshore trusts act as a critical device for those aiming to boost their economic tradition while reducing prospective dangers.

Tax Benefits and Factors To Consider

While many financiers are attracted to offshore counts on primarily for asset defense and estate preparation, considerable tax obligation benefits and considerations additionally warrant interest. Offshore investment vehicles can supply positive Clicking Here tax obligation regimens, which may result in reduced tax obligation obligations contrasted to onshore alternatives. Many territories supply tax obligation motivations such as tax deferments, reduced capital gains prices, or even full tax obligation exemptions on certain kinds of earnings.

Nevertheless, it is important to navigate the facility landscape of worldwide tax regulations. The Foreign Account Tax Conformity Act (FATCA) and various other laws need united state citizens and citizens to report international assets, potentially leading to charges for non-compliance. In addition, the Irs (INTERNAL REVENUE SERVICE) may enforce taxes on overseas income, negating some benefits if not effectively handled

Conclusion

In verdict, overseas investment alternatives present diverse possibilities for asset security, diversification, and estate planning. Offshore financial institution accounts improve personal privacy, while actual estate investments provide security against residential unpredictabilities.

Offshore real estate supplies one-of-a-kind benefits, such as desirable tax obligation routines, possession protection, and the possibility for resources recognition.While lots of capitalists are attracted to overseas trust funds largely for property defense and estate preparation, substantial tax obligation advantages and factors to consider also merit attention. Offshore financial investment lorries can provide desirable tax programs, which may result in lower tax obligation obligations compared to onshore options.Investors need to additionally consider the influence of neighborhood tax obligation legislations in the offshore territory, as these can differ dramatically. Eventually, while offshore financial investments can produce significant tax advantages, detailed due diligence and strategic planning are critical to maximize their potential.

Report this page